Getting The Good House Plans To Work

Wiki Article

About Good House Plans

Table of ContentsThe Main Principles Of Good House Plans The 6-Second Trick For Good House PlansGood House Plans Can Be Fun For EveryoneGood House Plans - The Facts

House insurance coverage may also cover medical expenses for injuries that individuals sustained by being on your home. A house owner pays an annual premium to their homeowner's insurance company. Typically, this is someplace in between $300-$1,000 a year, depending upon the plan. When something is harmed by a calamity that is covered under the house insurance plan, a property owner will call their residence insurance policy company to submit a case.Property owners will generally need to pay an insurance deductible, a fixed quantity of money that appears of the house owner's purse prior to the home insurance provider pays any kind of money in the direction of the insurance claim. A home insurance coverage deductible can be anywhere between $100 to $2,000. Normally, the higher the insurance deductible, the lower the annual costs expense.

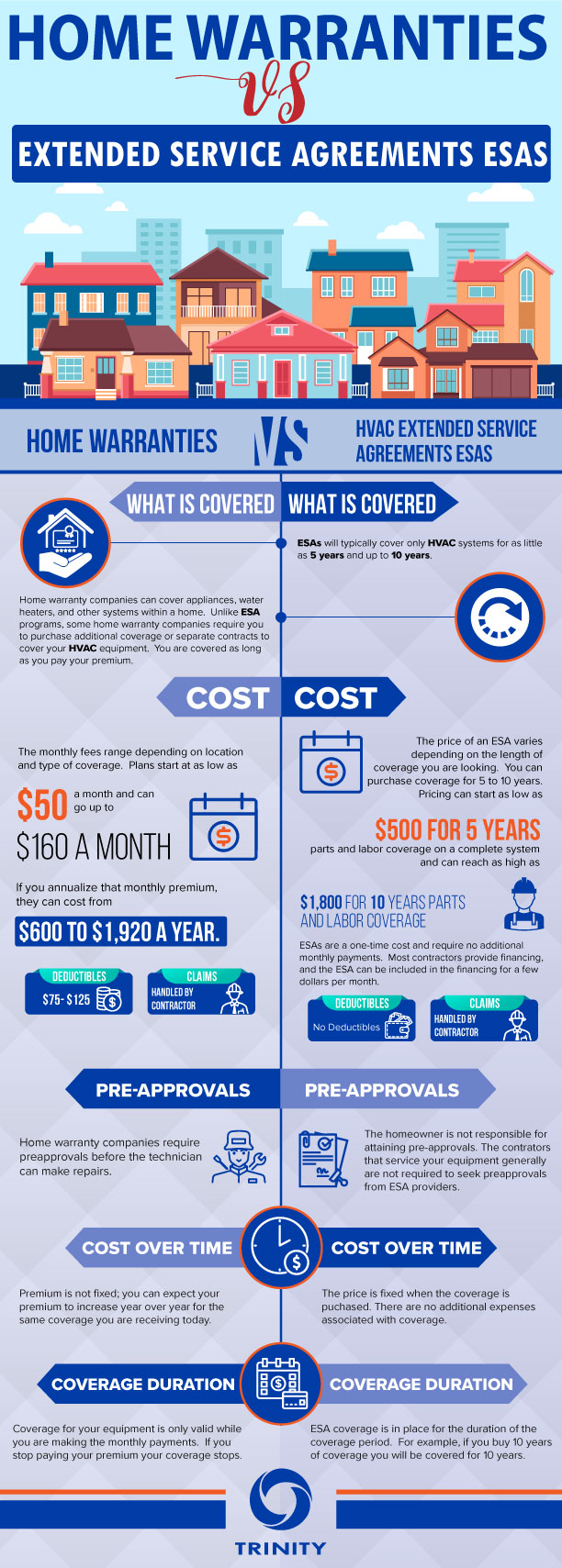

What is the Distinction Between Residence Guarantee and House Insurance A house service warranty contract and also a home insurance plan run in similar methods. Both have an annual premium as well as an insurance deductible, although a house insurance policy premium and also insurance deductible is often much greater than a home guarantee's. The major differences between residence guarantees and also home insurance coverage are what they cover.

Another difference between a residence warranty and house insurance coverage is that house insurance policy is usually needed for homeowners (if they have a mortgage on their house) while a house guarantee plan is not needed. A house guarantee as well as house insurance policy supply protection on different parts of a residence, and also with each other they can shield a home owner's spending plan from pricey fixings when they certainly chop up.

Get This Report about Good House Plans

If there is damages done to the structure of the house, the proprietor won't need to pay the high costs to repair it if they have residence insurance coverage. If the damage to the residence's structure or homeowner's belongings was caused by a malfunctioning appliances or systems, a home service warranty can assist to cover the costly repair services or replacement if the system or device has fallen short from normal deterioration.They will certainly work together to give security on every component of your house. If you're interested in acquiring a house service warranty for your home, have a look at Landmark's house warranty plans as well as rates right here, or demand a quote for your house here.

The difference is that a home service warranty covers a range of products instead than simply one. There are 3 conventional kinds of residence service warranty plans.

Good House Plans Can Be Fun For Everyone

Some products, like in-ground lawn sprinklers, pool and septic systems, might need an added service warranty or could not be covered by all residence service warranty firms. When contrasting house warranty business, make certain the strategy options include whatever you 'd want covered.New construction homes typically included a warranty from the contractor.Contractor warranties generally do not cover devices, though in a new residence with new appliances, manufacturers' service warranties are most likely still in play. If you're getting a home warranty for a brand-new home either brand-new building or a house that's new to advice you insurance coverage normally starts when you close.

, your house warranty business might not cover it. Rather than relying entirely on a warranty, attempt to negotiate with the vendor to either remedy the problem or offer you a debt to help cover the price of having it repaired.

You do not have to study and also get referrals to find a tradesperson whenever you need something dealt with. The other hand of that is that you'll obtain whomever the residence warranty firm sends out to do the evaluation as well as make the repair. You can not pick a professional (or do the job on your own) and then obtain compensated.

Little Known Facts About Good House Plans.

For one, home owners insurance policy is needed by loan providers in why not try here order to obtain a home mortgage, while a residence guarantee is entirely optional. As pointed out above, a home service warranty covers the repair service and substitute of products and systems in your residence.Your house owners insurance, on the various other hand, covers the unforeseen. It won't aid you replace your devices since they got old, however property owners insurance can assist you obtain new devices if your existing ones are damaged in a fire or flooding. With house owners insurance, you'll need to fulfill a deductible prior to the insurance company starts paying for the price of your insurance claim.

Though you won't spend for the real repair work, you will certainly pay a service fee every time a tradesperson involves your house to assess an issue. If even more than one pro is needed, you might end up paying a service charge more than as soon as for the exact same job. This cost can range from about $60 to $125 for each and every service circumstances, making the solution charge another indicate think about if you're going shopping for a residence guarantee plan.

Report this wiki page